- Share on :

- More

Allowance for Doubtful Accounts Intermediate Financial Accounting II Vocab, Definition, Explanations Fiveable

Two primary methods exist for estimating the dollar amount of accounts receivables not expected to be collected. If it does not issue credit sales, requires collateral, or only uses the highest credit customers, the company may not need to estimate uncollectability. Including an allowance for doubtful accounts in your accounting can help you plan ahead and avoid cash flow problems when payments don’t come in as expected. Let’s consider a situation where BWW had a $20,000 debit balance from the previous period. This application probably violates the matching principle, but if the IRS did not have this policy, there would typically be a significant amount of manipulation on company tax returns. For example, if the company wanted the deduction for the write-off in 2018, it might claim that it was actually uncollectible in 2018, instead of in 2019.

Income Statement Effects

Assign a risk score to each customer, and assume a higher risk of default for those having a higher risk score. Recovering an account may involve working with the debtor directly, working with a collection agency, or pursuing legal action. is allowance for doubtful accounts a permanent account Say you’ve got a total of $1 million in AR, but you estimate that 5% of it, which is $50,000, might not come in. Note that if a company believes it may recover a portion of a balance, it can write off a portion of the account.

- For example, a jewelry store earns $100,000 in net sales, but they estimate that 4% of the invoices will be uncollectible.

- It reduces the accounts receivable balance to its estimated realizable value to account for potential bad debts.

- By estimating the expected uncollectible debts and creating an allowance for them, you can minimize the risk of significant losses arising from bad debts and ensure accurate financial statements.

- This will ensure that your financial statements accurately represent the status of your company’s accounts receivable.

Allowance for Doubtful Accounts and Bad Debt Expenses

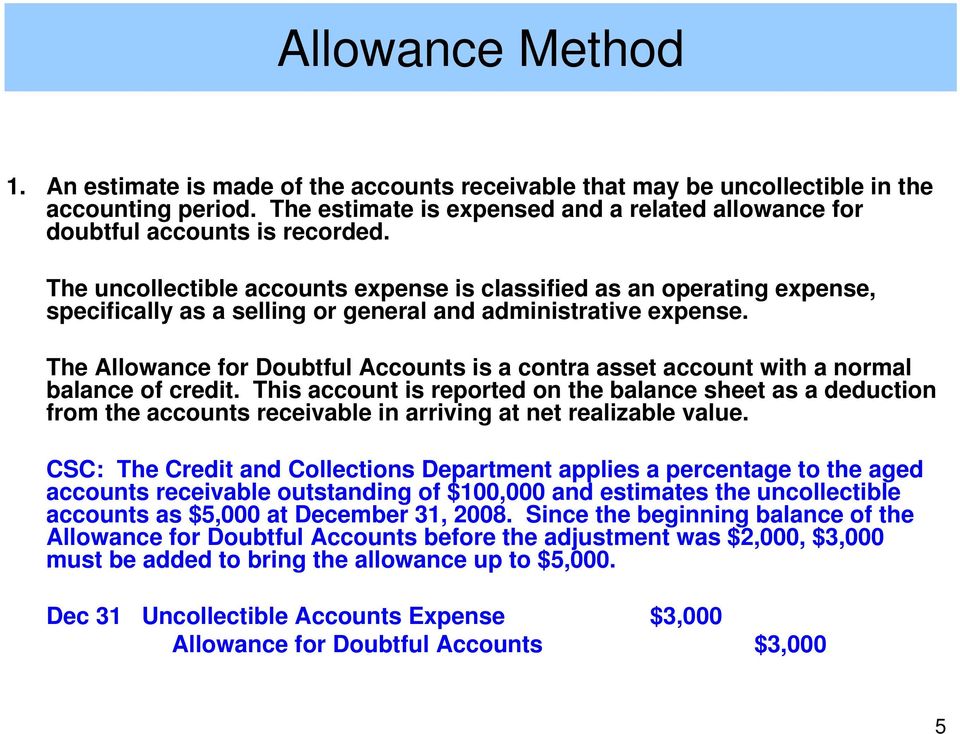

The allowance for doubtful accounts is not always a debit or credit account, as it can be both depending on the transactions. When a doubtful account becomes uncollectible, it is a debit balance in the allowance for doubtful accounts. Yes, GAAP (Generally Accepted Accounting Principles) does require companies to maintain an allowance for doubtful accounts. According to GAAP, your allowance for doubtful accounts must accurately reflect the company’s collection history. Companies create an allowance for doubtful accounts to recognize the possibility of uncollectible debts and to comply with the matching principle of accounting.

Stay up to date on the latest accounting tips and training

Another approach is the percentage of receivables method, which focuses on the outstanding accounts receivable at the end of a period. This method involves applying different percentages to receivables based on their age, as categorized in the aging schedule. For example, receivables that are 30 days past due might have a lower percentage applied compared to those that are 90 days past due.

How the accounts receivable aging method works

Days Sales Outstanding (DSO) is used with windows, like 0-30 days, days, and days, are considered. If a doubtful debt turns into a bad debt, credit your Accounts Receivable account, decreasing the amount of money owed to your business. Use an allowance for doubtful accounts entry when you extend credit to customers. Although you don’t physically have the cash when a customer purchases goods on credit, you need to record the transaction. However, 10% of receivables that had not paid after 30 days might be added to the allowance for bad debt.

The outstanding balance of $2,000 that Craft did not repay will remain as bad debt. When a specific customer has been identified as an uncollectible account, the following journal entry would occur. As you’ve learned, the delayed recognition of bad debt violates GAAP, specifically the matching principle. Therefore, the direct write-off method is not used for publicly traded company reporting; the allowance method is used instead. It’s important to note that an allowance for doubtful accounts is simply an informed guess, and your customers’ payment behaviors may not align. Let’s explore the importance of allowance for doubtful accounts, the methods of estimating it, and how to record it.

In some cases, you may write off the money a customer owed you in your books only for them to come back and pay you. If a customer ends up paying (e.g., a collection agency collects their payment) and you have already written off the money they owed, you need to reverse the account. For example, if 3% of your sales were uncollectible, set aside 3% of your sales in your ADA account. Say you have a total of $70,000 in accounts receivable, your allowance for doubtful accounts would be $2,100 ($70,000 X 3%). For many business owners, it can be difficult to estimate your bad debt reserve. If the doubtful debt turns into a bad debt, record it as an expense on your income statement.

To predict your company’s bad debts, create an allowance for doubtful accounts entry. To do this, increase your bad debts expense by debiting your Bad Debts Expense account. Then, decrease your ADA account by crediting your Allowance for Doubtful Accounts account.

The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. The longer the time passes with a receivable unpaid, the lower the probability that it will get collected. An account that is 90 days overdue is more likely to be unpaid than an account that is 30 days past due. It reduces accounts receivable on the balance sheet to reflect the amount expected to be uncollectible. This adjustment helps maintain accurate financial records by accounting for potential bad debts and helps businesses prepare for future bad debts. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet.